State of Florida TIITF Road Easements

Educating The Public

The Last Trail of Tears Because of Government AbuseThe State of Florida Trustees of the Internal Improvement Trust Fund (TIITF Board)

Governor Jeb Bush - Charlie Crist Elected

Comptroller Tom Gallagher - Alex Sink Elected

Attorney General Charlie Crist - Bill McCollum Elected

Commissioner of Agriculture Charles H. Bronson - RELECTED

Agent for Release of TIITF Easements

Department of Environmental Protection Colleen M. Castille

Jack Wolff Applications for release of TIITF easements

When and if you send a protest letter about the unfair TIITF easements, copy the letter to all the members of the TIITF Board. Tell them this problem began by a motion of the TIITF Board in 1940 and it can be resolved by a similar motion correcting the injustices.

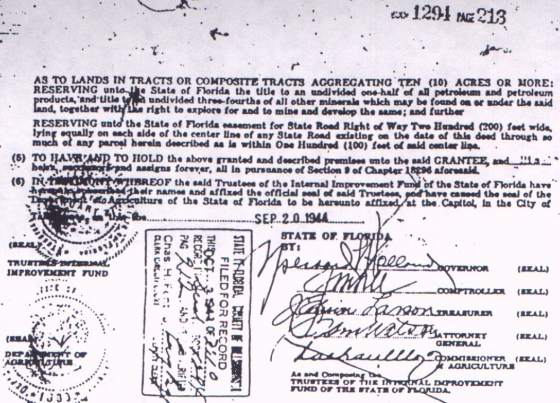

What Is A TIITF Easement?

Notice first in all caps the words:

1.) AS TO LANDS IN TRACTS OR COMPOSITE TRACTS AGGREGATING TEN (10) ACRES OR MORE.

NOTE:

a.)Some deeds convey multiple parcels because they were individually auctioned according to tax certificates. These were usually formerly owned by different owners. When a successful bid is received the bidder is granted that parcel. All parcels he bid on that day are usually contained on one deed. Each bid won is placed on the Murphy deed as an individual and separate tract from the others on the deed. Each parcel(s) that is/are conveyed separately on the deed that aggregate or composite ten acres or more would be subject to the reservations. The ten acre clause must be applied to each separate tract on the deed. All or some of the tracts may be more then ten acres and the reservation would apply. All or more of the tracts may be less then ten acres and the reservation would not apply. Many thousands of TIITF deeds do not contain tracts that composite or in the aggregate consist of ten acres or more. It is error and fraud to take all the separate tracts won by the bidder in totally separate auction items, and collect these into one aggregate or composite tract. The fact is each tract conveyed on the deed is a separate bid won at the public auction and that is why there is a bid price for each separate from the others. If they were considered one composite and aggregate tract, they would all have been auctioned as one parcel with each legal broken out but no bid price assigned individually. Our opinion is if the deed does not contain a tract as bid by the bidder, that does not contain ten acres or more in each parcel or tract conveyed on the deed, the reservation was not intended to exist.

b.) Did the State of Florida enforce its reservations of petroleum, petroleum products, and minerals against any deed that did not contain an aggregate of ten acres or more? I asked this question to Mr. Jack Wolf and he sat there in his chair like a frog in a hail storm and would not answer my question. He could not tell me of one parcel under ten acres where the State went in and took minerals or petroleum. Obviously, if the State did not enforce the petroleum and mineral reservations on deeds that contained less then the 10 acres, why would this same ten acre rule not apply to deeds with road Reservations?

c.) If the State did not enforce the 10 acre rule to claim petroleum and mineral rights, then the whole of all reservations are made null and void on the basis the parcel on the Murphy Deed contained less then the 10 acres.

2.) RESERVING unto the State of Florida easement for State Road Right of Way:

All the language that follows was to apply to this ten (10) acre rule. And it did apply from the 1940s until at least May 16, 1978 as contained in the State Road Department letter linked below. Sometime in the late 80's officials met in the conclaves of the State Capitol to scheme a way to change this. With careful corruption of the facts, the State of Florida through the Trustees of the Internal Improvement Fund and its designated agent, the Department of Environmental Regulations, altered the interpretation of this language all to steal billions of dollars of private property value from Florida property owners. My goal and ambition is to reverse this gross injustice and to stop abuse against Florida property owners and title companies by the courts and government agencies.

In the Mann v. State Road Department case, English Professor Dr. Robert A. Bryan, of the University of Florida, gave expert testimony in a sworn Affidavit on the grammar and construction of the reservation clause. He stated that the construction of the reservation language by all standards of composition of the English language, applied to the reservation of easement for State road right of way. Dr. Bryan's expert testimony could not be impeached by the State of Florida. So the State tried another act of fraud against the clear grammar of the deed. They slipped into their brief a legal summary of the minutes of the Trustees from 1940-1945 to the First District Court of Appeals. Thank God, Attorney James F. Lang (Gainesville), moved to strike this (out of trial court submission of evidence): and the Judge struck it down with his gavel and ruled that Dr. Bryan's composition concerning the grammar of the reservation clause was accurate and he agreed with it. Thus, this high Court reversed lower court rulings and Mr. Mann was awarded proper compensation at 100% of land value for the parcel he had from a Murphy Deed that contained less then ten acres. But, the State is still trying to enact fraud on the expert testimony of Dr. Bryan, and come up with some other trick to say the ten acre clause does not apply to road right of way easements.

Now, as it relates to 40th Street properties here in Tampa, the law firm of Macfarlane, Ferguson, and McMullen, attorneys for the City of Tampa, have compiled their own "legal summary" of the Minutes of the Trustees from 1940-1945 and intend to use this against property owners in eminent domain suits. They will make sure this evidence will be placed in the trial court record so it will not be rejected in the case of appeals. But, what they will NOT PLACE IN THE TRIAL COURT RECORD is any Minute that contains an interpretation of the TEN ACRE CLAUSE by the Trustees. In other words, they will introduce their own arguments and opinions on what the Trustees intended, without one word from the Trustees. This is not prima-facie this is prima-pseudo-facie! This law firm if it was honest and had integrity would review the Affidavit of Dr. Robert A. Bryan filed in the Mann case and accept the accurate testimony of this expert witness. They would advise the City of Tampa that honesty and integrity demands the meeting of the minds and intent of the parties be understood as Dr. Bryan states in his review of the grammar. We will see if the City has hired a reputable law firm or if they have hired shysters to shyster the court system. This will come to the forefront as soon as suits are filed and we will anxiously await to see if this law firm introduces this tactic. We will see if they are indeed honorable. We will observe to see if shysters show up to shyster the jury and the judge.

Current interpretations of the Murphy Act allows the State of Florida and its political subdivisions to rob the people of Florida out of several billions of dollars in private property value. Using lies, misrepresentations, outright fraud, unfair court rulings, and fradulent opinions of state-hired appraisers, the people of Florida continue to suffer governmental abuse. All of this amounts to legalized governmental tyranny and robbery. We hope this site offers some education to the unsuspecting property owners of Florida. I have drafted proposed legislation I hope some Representative and Senator will sponsor. We also hope that in some distant legislative session these offenses will be stopped and private property rights fully protected. Until this is accomplished, we seek an enterprising attorney who will build a class-action case against the FDOT, the various counties and cities, the FDEP, the TIITF Board, and the State of Florida.

Lying to the public to coerce and induce them to purchase Murphy Act properties

When Murphy Act parcels were individually being sold at public auction beginning in 1943, buyers were told the easements being reserved were for future State roads on the State Road System, and if the road fronting a parcel was not used for a State Road, the easement would be invalid. They were told the reservation was only on deeds that contained 10 acres or more. Now, over 60 years later, property owners discover government officials altering these statements and going into court claiming the ten acre clause means nothing, and that these easements can be used for roads not on the State Road System.

Based upon representations made to the Murphy Act land purchasers by FDOT in its rules and regulations concerning TIITF easements, these property owners built homes, businesses, and other improvements on these easements. From 1941 until 1978 under the reclassification requirements of the Florida Legislature for State roads, there never was a State Road maintenance truck or vehicle on thousands of these roads. The 1941 legislation designating State Roads was nothing but a legal sham to grab land. Not only did the Florida State Road Department NOT PHYSICALLY CLAIM THESE ROADS TO BE ON THE STATE ROAD SYSTEM, THEY DID NOT MAINTAIN THEM! Because the Counties and Cities would not maintain State Roads many of these roads saw no maintenance and were in a sad and sorry condition for 30 years! Many thousands of those roads designated State Roads in the 1941 legislation NEVER WERE OFFICIALLY MAINTAINED AS STATE ROADS. They were never surveyed. There was never a legal description made of them and filed of record. All we have are maps made by FDOT that never were filed of record until AFTER THEY WERE NOT ON THE STATE ROAD SYSTEM. We have maps with hand written information that no one knows who did it, when, or where. These were never filed of record. Many hundreds of thousands of miles of road bed that are considered dedicated road ways, and in fact still held in fee by title properties because there never was a taking, never was a dedication, and never were reserved by a government entity. Now, there is a State Law that gives the maintained road bed to the government entity who has maintained it for so many years. But the government entity still does not own from edge of pavement to the property lines now identified on surveys. The 1941 legislation designating all the streets, roads, boulevards, highways, avenues as State Roads was to initiate the largest rip-off of private property in the nation. Not since Florida ripped the Seminole Indians away from their lands, stole it, and marched them cruely to an Indian reservation out midwest, has there been such a travesty of justice. And yes, the Murphy Act has created its own Trail of Tears with thousands of property owners victims who cry 365/12 because of continued government and lawyer abuse.

Believing the State did not own or had abandon the easement rights, especially on parcels under ten (10) acres, and indeed having been told this to them by State Highway officials, Counties and Cities issued building permits to construct homes, businesses, and other improvements on these easements. Because Florida attorneys were told the ten acre clause exempted reservations on conveyances less then 10 acres, they did not construct deeds containing the easement reservation. Attorneys relied upon the Rules and Policies promulgated by the Florida State Road Department and its successor the Florida Department of Transportation (FDOT).

Here is a copy of the old Florida Department of Transportation guidelines that attorneys used as the legality for their not recording the reservations on deeds containing less then ten acres. What you will read in FDOT's Rules will clearly show parcels under ten acres did not contain a reservation. It was these guidelines that were used by County and City building departments to issue building permits in the areas where an asement is claimed. Attorneys and title companies from 1941 until 1978, some 37 years, used these State Road Department guidelines to determine if a reservation existed.

More importantly, I have researched the Minutes of the Trustees and did not find a single protest from 1940-1978 against the Rules and Policies of FDOT claiming that road easements on ten or less acres WERE VALID. There is not one iota of evidence in the Minutes I could find protesting. Instead, what do we find? We find FDOT and its predecessor the SRD sending application after application for 37 years with a cover letter explaining a parcel contained 10 or less acres and recommended release. And what did the TIITF Board do? THEY RELEASED THEM IN TOTAL AGREEMENT WITH THE DECISION AND INTERPRETATION OF FDOT. Is this not EVIDENCE of the intent of the Grantor in this matter on the ten acre clause? I say that it is and I say the conduct of FDOT and the TIITF Board is all the witness we need they are now estopped from asserting a different intent of the Grantor. It's time for Summary Judgment.

After the Kortum case debacle in 1991 by the law firm of Brigham, Moore, Gaylord, Wilson, Ulmer, Schuster, & Sachs, nearly all legal remedies were slammed shut on the public concerning those deeds which conveyed ten acres or more. The Kortum deed did not contain a ten acre clause. It did not fall under the release guidelines of FDOT which existed in 1978. The issues reaised by the Plaintiffs were all failures because they were not presented with factual foundational information. The lawyers for Kortum did not properly present the issues of the Murphy deed. The judge was so void of the facts of what constituted a "state road" on the state highway system he invented his own theory to cover up for his own igorance. He sat to judge words and laws he knew nothing about. He was as bad as the lawyers before him. It appears he was relying on private information provided to him from sources within FDOT, FDEP, and TIITF Board officials who were then infiltrating the government system with changed interpretations.

Proving the reservation was for State Roads on the State Road System meant nothing. The Plaintiff''s lawyers were asleep on this one! The fact building permits were issued relying upon the reservation to be invalid meant nothing. The fact taxes were paid on these easements meant nothing. All that mattered was the 1941 legislation designation state roads and if the deed was to property adjacent to one of these roads, the reservation was considered valid regardless if it was still on the state highway system.

The Mann case decision or parcels of less then ten acres ruled over these errors of circuit judges, but the State would not give up so easily. FDEP, writing an Order of Fact of Finding stated that the Mann case was not depositive of the ten acre issue. My how they ran spiked-footed over Dr. Robert Bryan's Affidavit on the English grammar constuction of the reservation clause. That is one testimony they will NEVER IMPEACH so they did not deal with it now did they? And they will not want to deal with it now! The Florida Fund Title Company underwriting guidelines were changed and the ten acre rule was cast out as a test. The Fund rolled over in bed with the FDEP on English grammar and Dr. Bryan's analysis of the ten acre clause. The Fund has both the money and the lawyers with the expertise to right this travesty of injustice, but they refuse to guard the public and come to the defense of the public. They suck up millions and millions of dollars from the public each year but don't have the honorability to right the falsehood against Dr. Bryan's Affidavit.

While the ten acre clause was not on the Kortum deed, the law firm of Gaylord-Wilson was in my opinion sloppy, inept, unprepared, and did not properly utilized discovery methods to obtain vital information. They did not bring forth enough valid arguments to win their case on the appellant level before the District Court of Appeal Second District. Kortum lost big time because of poor attorney representation and he told me if he had it to do over he would have taken the first offer. But the attorneys assured him he would win. In the end it got $14,400 of $150,000, little to nothing. Maybe the fault partially lay in the fact the government does not adequately compensate attorneys in court actions to pay for good representation. So the public gets beat up in the courts where the State has very deep pockets to chop up a citizen. The defense offered to property owners with small parcels where s small amount of land is to be taken is limited to a little eminent domain stipend that is not sufficient to give an attorney an excited reason to try and beat the State?

Many lawyers, relying upon past treatment of these easements and release by both the Florida State Road Department and its successor the Florida Department of Transportation and the Trustees of the Internal Improvement Trust Fund, have, since the Kortum case ruling, changed their attitude and aggressiveness toward defending the public against TIITF easement takings. Their minds are fresh out of arguments and they are to lazy to get out of their padded office chair to go out and stomp through the halls of government to get some fresh information and evidence of wide wrong-doing. They sign on an eminent domain case promising they will protect and defend the rights of the property owner when in most cases involving the TIITF easements they are i n kahoots with the government. Some are so stupid they do not even know who sits on the TIITF Board! They never researched the TIITF Board Minutes for information on these reservations. In many of these cases I believe the attorneys are shysters, hogs at the public trough, do not know how to figure the worth of the underlying fee of an easement, and should be disbarred. The Florida Bar should be ashamed it has not come to the aid of the public concerning the abuse that has taken place by government with these TIITF reservations.

If there is an attorney that still has the guts and the professional drive to defeat the State on these TIITF easements I have not met him/her yet (well, maybe, I"ll know in a few months). Most want to collect their fee, will not attend public hearings for their clients (especially in pre-taking zoning and comprehensive plan changes), push some paper work, show up at the closing, and then get their check.

I do not believe the most of them have the mental capacity or the expertise to even take a case to court. So, I have spent over 10 years of my own money and time to educate myself on these TIITF easements. Because of my involvement, Senator James Hargrett, Jr. appointed me to come to his Senate Transportation Committee and be a representative for the people of Florida who have these TIITF road easements on their property in hearings and meetings he wanted to hold. I helped to draft legislation that was sponsored by Senator James Hargrett, Jr, (SB2410, 1997) to correct these injustices. After many meetings with the the Florida Department of Transportation and in particular Ken Towcimak, the Department came out in favor of release of all these easements. They confessed there were many inequities in the release process. But the attack came from Hillsborough County Real Estate Department who obtained the support of other Counties through their political action committee, the Florida Association of Counties. In 1998 the 1997 legislation was gutted and a new bill filed that was filled with enormous legal danger to the public and would have increased government abuse 100 fold. Knowing I would object to these deliberate additional injustices, I was not called or invited to participate in the Senate Transportation Committee meetings on this bill and when I discovered it, made a loud protest. The 1998 bill had cleared the Senate and was on calender in the House for passage. With last minute phone calls from Alaska, I was able to have the bill die and not reach the floor for a vote. THANK GOD for Senator Hargrett and his "word" to have the bill pulled in the House (This is an honorable man). Senator Hargrett's legislative opportunity has expired because of term limits. It is time for some Legislator to take up this issue again and bring forth legislation that will correct the abuse not add more upon that already suffered since 1941. It is time for a public victory against this massive land fraud swindle and I aim to do everything I can to stop future abuse of Florida citizens by public officials and the courts. Ultimately I hope to obtain redress either directly through the TIITF Board or by legislative enactment. If I can find a TIITF Board with compassion for justice, these inequities will be corrected instantly. With faith in God, confidence in Jeb Bush as a man of integrity and compassion for hurting citizens of Florida, I look for victory soon. If not, then legislative relief is the only solution.

This page is to bring public awareness to the problems of the TIITF easement and to offer some suggestions on how to defeat the State's practice of stealing property without fair and proper compensation.

First, write an email to all the members of the TIITF Board asking for redress for over 60 years of injustice and abuse concerning these TIITF road easements.

Second, Then write a letter to your Florida State legislative delegation and tell them you believe the Florida TIITF road easements are unfair and abusive to property rights of Floridians and ask for legislation to correct the injustice. Send them the URP of this web page.

Third, demand from the Florida Bar that they undertake a special blue ribbon panel of attorneys in the area of eminent domain and start a process to redress before the courts a better representation of the public. When the public welfare is endangered by attorneys who do not properly represent their clients, the Florida Bar has a duty to act. Regardless if a complaint is filed against an attorney or not, the Florida Bar should intervene and begin some form of an educational process so this does not continue. They could even present an AMICUS CURIAE brief in Murphy Act trials to show how the change in Rules came about after 37 years and put lawyers, title companies, and property owners at financial loss. How come they have not done it already?

Fourth, judges should be thoroughly informed about all the information available concerning these TIITF easements, the change in interpretation of the ten acre clause, and the different treatment of property owners since the change took place. In this manner, if an attorney is not properly representing his client(s) either through stupidity and or ignorance, the judge will not rule in favor of the government robbers to the detriment of the public, but will reinforce the sanctity of law that no unfair advantage take place against an innocent property owner.

Fifth, educate yourself. You would think the government of Florida would know perfectly about these TIITF easements. The fact is they are confused and give conflicting and often contradictory information. Learn, learn, learn, until you get a firm grip on what has happened and what is going on. Try to locate citizens who have been beaten up and abused by attorneys who did not represent them properly and by FDOT or other agencies who have used lies and unfair advantage to obtain these easements in full fee simple without one penny of compensation. Educate yourself!

The Education Starts Here

What is a TIITF Road Easement?

Is There A List Of Florida Case Law I Can Review?

How do I know if there is a TIITF Easement on my property?

Are Title Company Exclusions Valid?

Does the State of Florida Own The TIITF Easement Property?

What is the value of the TIITF Easement?

Are You Entitled To Free Attorney Fees If The State Uses the TIITF Easement?

Can Federal Funds Be Used To Purchase TIITF Easements?

What is a TIITF Road Easement?During the depression years there were millions of acres of Florida that were on the tax rolls. Property taxes were used to pay and support infrastructure such as roads, sewers, water, fire protection, schools, etc. and operation of public government.

Because of the depression 1930-1937, many property owners had no money to pay the taxes on their property. Many properties were owned by northern snowbirds who purchased lots through massive mail order programs. When the depression hit and taxes were not paid the local governments had little money to operate on. By 1937 there was an approximate $97,000,000.00 in unpaid property taxes throughout Florida. When taxes are not paid the county in the jurisdiction of the property has authority to sell tax certificates in the amount of the value of the taxes due, the certificates themselves bearing interest. Because there were few with money to purchase these tax certificates, the taxes went unpaid and county governments found themselves in need of money and no place to obtain it. These tax delinquent properties remained on the tax rolls year after year with no apparent resolution to the problem. This dragged on until in 1937 the Florida Legislature passed the Murphy Act (Chapter 18296). The Murphy Act empowered the State to begin the process of foreclosure on these tax delinquent properties and transferred to the Trustees of the Internal Improvement Trust Fund (TIITF), the ownership and the right to dispose of them at public auctions.

Before these tax delinquent properties were placed at public auction, the director of the State Road department made a request to the TIITF board to reserve an easement on these properties before they were sold, the easement to be used for future State Road right of way improvements. It is to be "carefully" noted, that the original request was for State Road right of way reservations and not future easements for county or city road or street right of ways. I have researched the Minutes of the Trustees with a fine-tooth comb from 1937-1950 and have not found a single entry that these easements were reserved for "public roads" in general throughout Florida. The idea of changing the language of "State Roads" to "Public Roads" did not take place until the ruling of Judge Parker in the Kortum Case. Judge Parker was in error and did not rely upon the Minutes of the Trustees to determine the meaning of "State Roads" but rather legislation that had nothing at all to do with TIITF easements. The language specific to "State Roads" was offered by Governor Cone who championed the request for easements for the State Road Department in his motion or suggestion at the Nov 29, 1939 meeting (see Minutes of the Trustees Volume XXII January 1, 1939 to December 31, 1940, page 180). If Governor Cone had intended these easements to be for "Public Roads" this language would have been used and the mention of the Florida State Road Department would also not have been designated the "sole" entity to use these easements. No action was taken at this meeting. Then on September 17, 1940 Secretary F.C. Elliot presented a written request by the State Road Department again asking for reservations on the Murphy Act lands in the possession of the Trustees. It is vital that the following language be understood clearly:

"Motion was made and seconded and adopted that easements for right of ways across lands where a State Road now exists be granted to the State Road Department in those counties where lists of certificates under Chapter 18296 have been furnished the Trustees."

1.) This motion is clear. There would be easements placed only along "State Roads" then existing on the date of this motion.

2.) The easement was for State Roads specifically and the State Road Department would be the beneficiary and NOT Counties and Cities.

3.) These easements would only be valid on those parcels where certificates had been issued by the counties and such certificates had been delivered and in the possession of the Trustees at the time this motion was adopted. If the certificates cannot be produced then the TIITF easement is not valid. All parcels where certificates were sent to the Trustees AFTER this adoption were excluded by the mere language of the motion. The reservations placed on the Murphy Act Deeds were to be judged legitimate or illegitimate by the language contained in this motion.

It is at least compelling that from 1941 until at least 1981 no County or Municipality obtained any of these reserved State Road reservations. For over 40 years they were deeded to the Florida State Road Department ONLY. I would like for someone to prove me wrong here. I have researched the State archives for deeds to a County or Municipality for these road reservations AND THERE AIN'T NONE!

The Appellate Judge erred and used other criteria to change the language of "State Roads" to "Public Roads." Now I am no attorney and I am not a shyster judge. There is a simple rule of law here. It does not take a degree in law nor a career on the bench to figure this out. Here it is: State Roads are designated by the Florida Legislature. Any road not designated by the Florida Legislature as a State Road IS NOT A STATE ROAD. The Florida Legislature does not designate all public roads. Therein lies the simple legal definition of State Road as found on Murphy Deeds and this was the intent of the Grantor. We know this is the intent, because reservations on Murphy Deeds are compared to Legislation that designates a State Road. But shyster attorneys and judges will pervert this and call this justice! The Second District Judge ignored a lot of facts that would have rendered a verdict for the Kortums. He used shyster trick and scheme in his theory State Roads means Public Roads. He even cited legislation in 1971 that did not exist in 1941, and used a stupidic form of theory to take something worded in Statute in 1971 as the INTENT OF THE GRANTOR in 1943. Figure that! As long as shysters sit on the Florida Court benches we can expect rulings such as this. But some where there is a man of character, a man of legal understanding, a man who believes in justice, and a man who will rule according to facts and not his opinion. He will render his opinion on the merits of facts not on the merits of manipulated opinion.

Another important item of interest here, is that when the Murphy Act lands were sold at public auction, the TIITF Board worked out a fee agreement with all the Counties to handle these public sales. The County would take out its agree share of the proceeds of the sale and forward the balance to the State. So, the Counties received "FULL" payment for their interest in these Murphy Act lands and the remaining interest and value rightfully belonged to the State of Florida alone. The State of Florida through the TIITF Board Trustees could, as any other property owner, dispose of their interest, including the mineral rights and road easements, at anytime they wanted. At no time has the TIITF Board ever said or agreed that the Counties share in any of the mineral rights under the Murphy Deeds, but now all of a sudden we find some claiming the County has "share" rights in the road easements reserved for State Roads in the Deeds? Our position is that if the easements were reserved for "Public Roads" and all the Counties benefit, then this ought to also apply to the value of the mineral rights reserved on the same Deeds IN THE SAME SENTENCE! If the latter is not acceptable and true, then it is also not true that the road easements benefit the Counties! Especially when the Counties were already paid their share of the proceeds arising from the sale each Murphy Act parcel. The Counties have already received all their share and that should settle the issue that when these easements are not to be used for State Roads, then they rightfully should be extinguished. Should the TIITF Board give or grant these easements to be given to the Counties? We believe to do so and to claim this right under the idea of "shared governmental" assets, that this establishes the precedent that the value of the mineral rights are also to be shared. Counties short on cash should look into this pool of resources to fund unfunded State mandated programs.

I have tried for several years to ascertain which parcels and certificates were in the possession of the Trustees on the date of the motion made on 9-17-1940 to no avail. The State has been uncooperative. Jack Wolff, the employee of the Department of Environmental Protection that oversees TIITF releases for the Trustees has refused to be of service or help in this area. The members of the TIITF Board themselves do not know which parcels and certificates were in the possession of the Trustees on September 17, 1940 to qualify all subsequent reservations placed on all Murphy Act Deeds. They rely instead upon the language placed on each Murphy Act Deed as evidence of a right of the State to exert its claim for ownership of the easement and place no value upon the qualifying criteria within the motion of 9-17-1940. Which criteria was never altered. And no where in the Minutes of the TIITF Board does it ever appear that they meant for the words "State Roads" to mean "Public Roads" in the sense other governmental entities beside the State Road Department would benefit from the reservations of the Road easements. If they did, why for over 40 years did only the State Road Department get deeds to these reservations and not ONE COUNTY OR MUNICIPALITY! And certainly, there is absolutely no mention of the mineral rights and share to be taken by the State, to also benefit other governmental subdivisions of the State. So far as I have been able to research, not one copper penny of value of the mineral or petroleum product rights reserved on Murphy Act Deeds has ever enured to the financial welfare of any County or City!

Someone within the office of the TIITF Board came upon a genius state-wide land-grab scheme. Since right of way reservations for easements for existing state roads was passed with no objections by the Trustees, someone came upon the idea why not designate thousand of county and city roads as State roads and by this secure on these Murphy Act Deeds even many more millions of miles of road right of way for future State Roads! Since the motion that gave rise to the Trustees to reserve easements for future State Roads specifically stated along "existing State Roads" these prospective county and city roads to qualify must be grabbed by the State and made State Roads before the Murphy Act Deeds were conveyed. This fact is ignored by the courts today. Why take these roads and designate them state roads. Just change the wording on the Murphy deeds to say State, County and Municipal Roads? They didn't because these reservations were for State Roads not public roads. There are honest judges who can see this but there are others that say the easements were for a public purpose and regardless if these roads were ever designated State roads for State road purposes or not, the reservations are legitimate and the property owner is not entitled to fair compensation for the value.

So, in the year 1941 the Florida Legislature passed Chapter 20659 (Hillsborough County), a massive real estate bill taking many tens of thousands of County and City roads and designating them State Roads. This legislation was signed into Law by the Governor on June 3, 1941. County by county every road being taken from the Counties and Cities by the State was listed in the legislation. All of this was done to have in place the legality of claiming these were existing State Roads at the time Murphy Act Deeds were conveyed and make legitimate the reservation on such conveyances along these roadways.

Once the legislation was in place, the State authorized the various counties to begin selling at public auction to the highest bidder all the these tax delinquent parcels. On each deed the reservation was stamped or printed just in case the property could be considered encumbered with this easement cloud. There was no effort by the State or the Counties to determine if the reservations were valid, they placed the reservations on all deeds and made it the responsibility of subsequent buyers to clear the title, even on titles to which there was no true and legitimate cloud. The validation process would be invented later and the State Road Department would determine the validity. If a TIITF Deed existed and was along a road designated a State Road in the Legislation, the reservation was considered valid. A property owner could challenge the reservation and or request it be released. For several years the rule was that if the parcel was less than ten acres the reservation was considered invalid and the property owner obtained a release. That however was changed and a new theory evolved in which the ten acre clause was deemed null and void.

These tax delinquent properties were then sold at public auctions. I have talked to some who are now deceased who said they were told at the public auctions that these easements were nothing, the State would never use them and the streets they were on, many dirt and shell roads, would never be wanted by the State. Indeed, over the years the State has released its claim on many thousands of miles of these roads and returned ownership back to Counties and Cities. In 1977 the Legislature passed House Bill 803 and Senate Bill 32-B that called for Functional Classification of Public Roads and to determine legal jurisdiction of these right of ways. During this process many thousands of roads were declassified as State Roads and fell back to Counties and Cities. When this happened we would think that the Murphy Act Deed reservations would have been automatically extinguished. They were reserved for future state Roads, the State passed legislation to make certain roads State Roads so they would qualify for the reservations, and now these were being reverted to the status they were in before the Legislature made its sweeping land grab in the 1941 legislation and designated them State roads to qualify for the language on the TIITF Deeds. But alas, the property owner is robbed again and a new opinion arose within the ranks of the Florida judiciary, that these reservations were indeed still valid, not as contained in the language within motion of the TIITF Board, not within the reservation on the Murphy Act deeds, but under a new strategy, that being these easements were to be set aside of a "PUBLIC USE" regardless if it be State, County, or City. This is theft by judicial decree. Many attorneys and title companies have rolled over and accepted this de-novo interpretations concerning these easements. And who suffers and is beat up? The attorneys? Nope, they are going to get their fat check and not lose a copper penny. Yep, those who will suffer the torments of this rip-off is John and Jane Q. Public.

The TIITF road easement measures 100 feet "each side" of the center line of a road that was designated a State Road in the 1941 legislation.

The easement is just that, an easement. An easement is not ownership of the underlying fee title. It is just the ownership of surface rights to use this area without cost, for State Road ROW purposes. That is if they only want to use the easement and not demand you sign over fee simple ownership to the underlying title. The easement may not create any other burden then that understood at the time of the reservation. On State Roads at that time there were no side walks, no storm water sewer systems, and few if any other utilities. Rights for these were not reserved and rightly the easement cannot be used for these without creating another series of easements which places a greater burden on the servient estate. The State does not own the underlying rights of fee simple title to this area of property. They can use the easement any time they want and they own rights to the easement for a state road bed ROW. It is wise for the property owner to make the State or Municipality go to court and prove the easement is located where it is claimed to exist as well as making sure the easement is not used for any other purpose that would create a greater burden on the servient estate (such as other easements). Sometimes center-lines of road beds changed or were not well established. It is important that the center-line of the road be determined at the time of the conveyance of the deed.

The State has been lying to property owners for over 50 years and many lawyers and attorneys have lied as well to their clients, and told them the State owns the land encumbered and there is nothing they can do but deduct the value of the square footage involved and take their losses. The State and other municipalities have been taking the easements and sometimes not even going through eminent domain and then creating other easements on them. Attorneys with sharp eyes can pick it up from here.

Is There A List Of Florida Case Law I Can Review?

Yes, and I am happy to give what I have found to you. Remember however, that some of these cases were tried by lazy attorneys and in some cases the decisions were handed down by deceived judges. No one knows how these cases would have come out if they had researched and consulted someone who had information before they went into trial.

CITATION

COURT/YEAR

TITLE

8 So.2d 483

9 So. 2d 716

10 So. 2d 577

10 So. 2d 484

15 So. 2d. 321

15 So. 2d 175

16 So. 2d 736

19 So. 2d 1

21 So. 2d 205

25 So. 2d 501

28 So. 2d 879

29 So. 2d 244

31 So. 2d 555

34 So. 2d 877

37 So. 2d 534

38 So. 2d 312

45 So. 2d 496

48 So. 2d 750

48 So. 2d 525

55 So. 2d 723

56 So. 2d 527

58 So. 2d 436

67 So. 2d 433

68 So. 2d 889

69 So. 2d 655

78 So. 2d 378

87 So. 2d 49

97 So. 2d 323

99 So.2d 248

102So. 2d 157

103 So. 2d 682

105 So. 2d 584

112 So. 2d 578

114 So. 2d 623

118 So. 2d 226

127 So. 2d 98

134 So. 2d 505

142 So. 2d 763

143 So. 2d 212

164 So. 2d 549

185 So. 2d 762

186 So. 2d 539

198 So. 2d 76

198 So. 2d 60

205 So. 2d 358

225 So. 2d 335

66-42 L

----------------

223 So. 2d 383

251 So. 2d 284

275 So. 2d 521

308 So. 2d 97

352 So. 2d 905

383 So. 2d 1171

409 So. 2d 7

417 So. 2d 1109

585 So. 2d 1029

-0-(Fla. 1942)

(Fla. 1942)

(Fla. 1942)

(Fla. 1942)

(Fla. 1943)

(Fla. 1943)

(Fla. 1944)

(Fla. 1944)

(Fla. 1945)

(Fla. 1946)

(Fla. 1947)

(Fla. 1947)

(Fla. 1947)

(Fla. 1948)

(Fla. 1948)

(Fla. 1949)

(Fla. 1949)

(Fla. 1950)

(Fla. 1950)

(Fla. 1951)

(Fla. 1951)

(Fla. 1952)

(Fla. 1953)

(Fla. 1953)

(Fla. 1954)

(Fla. 1954)

(Fla. 1956)

(Fla App. 2 D 1957)

Southern F.F. C. Dist

(Fla App. 2 D 1958)

(Fla App. 3 D 1958)

(Fla App. 2 D 1958)

(Fla App. 3 D 1959)

(Fla App. 1 D 1959)

(Fla App. 1 D 1960)

(Fla 1961)

(Fla App. 3 D 1961)

(Fla App. 2 D 1962)

(Fla App. 3 D 1962)

(Fla App. 3 D 1964)

(Fla App. 2 D 1966)

(Fla App. 4 D 1966)

(Fla App. 2 D 1967)

(Fla App. 1 D 1967)

(Fla App. 2 D 1967)

(Fla App. 2 D 1969)

Clay County Case

---------------------

(Fla App. 1D 1969)

(Fla App. 2 D 1971)

(Fla 1973)

(Fla 1975)

(Fla. App. 1D 1977)

(Fla App. 2 D 1980)

(Fla 1981)

(Fla App. 5 D 1982)

(Fla App. 2 D 1991)

-0-Boston & Florida V. Alford

Young v. Ewing

State ex rel. v. Holland

Peninsula v. Holland

Leon County v. Crawford

Hollywood v. Clark

Haynes v. Woodward

Pinellas County v. Banks

Andrews v. Andrews

Steele v. Freel

Stewart v. Powell

Royal Ins v. Smith

Caldwell v. Kemper

Golden v. Grady

Hunt v. Board of Com'rs

Swarz v. Goolsby

Bethea v. Langford

Thacker v. Biggers

Logan v. Ward

Ballard v. Gillbert

City of Oldsmar v. Monnier

Aldred v. Romano

Trustees v. Bass

Beck v. Littlefield

McCarty v. Booth

Wells v. Thomas

Newmons v. Lake Worth

Taylor v. Taylor

Albury v. Central

Traub v. Traub

H & H v. Goldberg

Adams v. Crews

Allison v. Rogero

Ahlheit v. State Road Dept.

Lobean v. Trustees

Trustees v. Lobean

West Hialeah v. City of Hialeah

City Tarpon Springs v. Koch

Rotolante v. Metropolitian Dade

Albury v. Gordon

Smith v. City of Arcadia

Southern Title v. King

Carman v. Gunn

Hart v. Florida Farms Service

Florida Board v. Lindsay

Addison v. Benedict

State Road Department v. Larsen ET AL

See Raymond O. Mann (see appeal below)

Mann v. State Road Department

General Dev. Corp v. Kirk

Trustess of Tufts v. Triple R. Ranch

Wernle v. Bellemeand Develop

Rowell v. All

Allen v. St. Petersburg Bank

Askew v. Sonson

Florida Dept of Rev v. Ford

Hillsborough County v. Kortum

Case # 88-20342I would like to say that the attorneys who represented Mr. & Mrs. Kortum were bad. They reduced their entire case of fee simple ownership based upon the Court's sole determination "whether the County receives the benefit of the easement for a road right of way which the State of Florida reserved in the deed executed in 1943." The Circuit Court Judge ruled the county did not have benefit. The County appealed and the 2nd District overturned this ruling and remanded it back to the Circuit Court Judge. And then, the Kortums were NOT PAID FOR THE UNDERLYING FEE TITLE! This is true HIGHWAY ROBBERY with the Judge holding the hammer as his butcher knife! For attorneys looking for information here: Murphy Deed 2925 to Vicente Fernandez did not contain the ten acre reservation clause for minerals, petroleum, and road right of way. The deed conveyed two parcels containing approximately ten (10) acres each. The road reservation was alone on the deed.

How do I know if there is a TIITF Easement on my property?

First look at your deed and see if a road easement is reserved in the legal description. Second, if it is not, then go get a copy of the Florida Statutes for the year 1941 and Chapter 20659 or the appropriate Chapter that covers your county. Look down the list of names of roads and streets to see if the street, road, or highway you live on is listed. If it is, then make sure you live on the stretch identified by Section, Township, and Range. Once you have determined your parcel is along a road designated as a State Road in the 1941 legislation, the next thing you must do is run a chain of title at your local Court House. This means you start with your deed and the past owner's name and search for the deed he/she obtained from the person who sold to them. You document the names of Buyers and Sellers and check all deeds back to 1941 or until you find the original deed from the Trustees of The Internal Improvement Fund to the buyer who purchased the property at the Murphy Act public auction. If you can trace your chain of title back to at least 1935 and there is no Trustee conveyed deed you are likely safe. All Murphy Act Deeds will be after 1937. You may check the County Tax Collectors records to review the taxes back to 1937. If these records show the property was tax delinquent it will also show that a certificate was sold and who owned the property. If the property was in the ownership of the Trustees of The Internal Improvement Fund, the chances of there being a TIITF road easement is nearly 100%. Whether or not it is valid is another thing to resolve. To be sure, you must research the chain of title until you have copies of all the deeds from yours all the way back to 1937.

If you discover you have a TIITF road easement on your deed, and if this was not written on the deed you obtained from the previous seller, then the easement "may" STILL BE VALID in spite of the fact it is not on the deed. You must then contact your title agency and make a claim to have the title cleared. The Title agency is on the hook to clear the title and spend an amount of money equal to the value of the sale price of the property against which the title policy was issued. Make them clear the title. They will drag their feet. Give them 60 days to clear title and if not HIRE AN ATTORNEY WHO KNOWS HOW TO SUE AND WIN! Do not hire an attorney who knows nothing about TIITF easements. There are some good attorneys and there are some bad ones. A bad one will tell you, you can't win! When you hear this keep searching! Usually, your title policy will prohibit you from hiring an attorney until they refuse to clear the title. Do not allow them to give you pennies for missing the easement. Since the State will want the value of the easement deducted from the whole value of the parcel, you can determine what the damages are to you by the amount of value they want to deduct from an offer of settlement. If you have a home or a business where the improvements are over in the easement area, the entire value of the improvements may also be considered a loss. Whatever you do, do not take a beating and do not allow a bad attorney to help them cheat you by poor advice and representation.

Are Title Company Exclusions Valid?

If a title company tells you at closing that there is a road right of way reservation on your deed, then the title company has performed its service in a professional manner and the exclusion they list will be considered valid.

Your real estate attorney should have a check off list to make sure you are protected and on the very top he should ask about easements and Murphy Act reservations. And if there are none mentioned and there is no need for an exclusion, your attorney will want all language that may give the title company a loop hole not to pay if they missed a road easement stricken out.

Most title companies do not examine the chain of title back 30 years. They will examine the title back to the date of the last issuance by another title company. In this manner each title company will be insuring the title during the term covered by their policy beginning at the date of issue. If the cloud was missed by a prior title company then each title company "may" eventually share in any damages. Make sure you know how far back the title company examined the title. Make them sign an affidavit stating how far back they examined the title.

Some title companies will not even examine the title for road easements and right of ways. Instead they will place language in the exclusion section usually stating: "All easements of record are excluded from coverage under this policy." They hope the holder of this policy will read this if something comes up and will think they have no remedy. This is not always the case. A "catch-all" phrase of such does not protect the title company if it can be proved that a diligent search would have disclosed the reservation. In other words, if a Title Company should have reasonably known of TIITF road easements in the vicinity of the property in question, they have due diligence to insure that the title they are insuring is not encumbered with this cloud. Most title companies in Florida maintain a file of Murphy Act parcels and the legislation of 1941 to check if the property they are insuring is located along any of these designated State roads. They have an obligation to check the title of a property they are insuring against these records in their possession.

Never take for granted that a title company has done its work. When you enter into any real estate contract in the State of Florida, make sure you insert a clause that states: "Property to be conveyed free of all Murphy Act Road Easements." Make sure on the title policy that it states: "Property is insured to be free of all Murphy Act Road Easements." Do not sign any final papers until this is done!

If a title company finds a Murphy Act Road easement and it is listed on its policy, and the policy states they are not insuring against the Road Easement, then make sure that the survey on the property shows EXACTLY where the road easement is located. DO NOT CLOSE THE DEAL UNTIL YOU HAVE A SURVEY THAT SHOWS THE EXACT LOCATION OF THE EASEMENT! If any of the dwelling or structure is located as an encroachment into the easement area, DO NOT BUY THE PROPERTY. Demand your money back and walk out of the sale. If any structure was built upon the easement AFTER the conveyance by the Trustees of the Internal Improvement Trust Fund, that structure is considered trespassing upon the government's easement and no value will usually be given to it in any negotiations for an eminent domain settlement. In some cases a good attorney has been able to get compensation. But do not take the chance. Some property owners have not been paid for houses, garages, wells, septic systems, parking lots, etc., located in the easement area.

If you are in doubt hire an attorney, one that has experience in the TIITF deed issue. If the attorney has never won a TIITF case do not select him/her. Keep looking. And, yes there are many good ones. The good ones have polished shoes, brush their teeth, wear suits or a nice dress, work hard, go to court and fight, depose witnesses, and use discovery to get vital and important information; and they carry errors and omissions insurance on each of their client transactions. The shysters push paper, always give excuse why they haven't done anything, never have a positive "we will win this" attitude, look and act like a used car salesman, talk trash and legalees to intimidate, do not depose witnesses or engage in discovery of relevant information that may help win a case, would have a heart attack if you demanded they try your case in court; and do not carry errors and omissions insurance.

Does the State of Florida Own The TIITF Easement Property?

No, the State of Florida does not own the easement property. It does not hold fee simple title to the easement property. All the State of Florida may own, is the equitable title to the use of the easement.

An easement is simply a right of use. The use is determined by the easement reserved. There are drainage easements where run-off storm water is allowed to cross over a parcel of property and the property owner may not block or in any way divert this water over onto another person's property. There are utility easements where gas, water, and sewer lines may be buried. Overhead in these easements are usually electrical and telephone wires. An easement is a right of use but it is not right of ownership in fee simple unless the easement is own in fee simple by the municipality. And an easement may not be used to create another easement or burden the servient estate beyond that implied in the easement.

The State of Florida owns the right to use the easement and they do not have to ask permission to do so. You can make them go to court and prove the location of the easement and its validity before you give over land. They can use it for the purpose associated with a road right of way only. And, the State does not have to pay one copper penny to use the easement if it indeed owns it. But, if the State wants the fee simple title to the easement and the underlying ownership, then they have every responsibility to pay reasonable compensation for it. And, if the State agrees to pay one penny in compensation, this awards the property owner all the rights pertaining to eminent domain taking. This includes but is not limited to having an attorney and professional consultants to aid and represent you.

Do not allow the State or a lazy attorney tell you that you are not entitled to a State payed for attorney if they intend to take your property under eminent domain proceedings. You don't have to receive a penny in the transaction and are entitled to State paid legal representation.

What do you own in regard to the easement portion? You own the title to the bundle of rights to the underlying fee. Look at it this way: the State will usually use a road bed easement about 12-18 inches in depth. From that point on down to the center of the earth the property owner owns and can use any way he deems fit. He can rent and sale the underlying fee title. He can maintain possession and exclude all others from it use. There are rights to this under the road bed property that the State does not own. And it is this property and bundle of rights that has value and for which you should be paid fairly. You may even own the property from the edge of road bed pavement to your property line. An attorney can determine this.

Do not sign a deed for this easement until you have been properly compensated. Remember, the State can use it anytime they want for free and without paying any compensation. But if the State wants ownership of the fee title to this area, then they must pay the prevailing value of such property. A way to make sure you will get paid for it, is to refuse to sign any deed conveying this underlying fee title to the State. Instruct your title company to prepare a deed that excludes the easement portion and convey this property ONLY. If the State claims they own the easement portion in fee simple there is no need to convey title to it. So do not convey title.

I have talked to State Road officials about this. They usually put a choke hold on Jane and John Q. Public by saying"

" You know, if you hold the title and do not convey it, you may be responsible for people who get hurt or killed on the portion of the road that is located over your fee simple title." I have responded: "And I will sue you, if you construct something upon the easement that may cause someone to be hurt, injured, or killed! Or, if you allow poison to be transported across it and it leaks and contaminates the rest of my property. Usually this resolves the impasse and we can then enter into negotiations about the selling price of the easement area owned in fee simple title.

Remember, the easement has value, the value assigned to it by the calculation figured per square foot of the entire value of the land area. Here is an important value factor. DO NOT ROLL INTO THE VALUE OF THE PROPERTY ANY VALUE OF IMPROVEMENTS. THE STATE IS NOT ENTITLED TO ANY PRORATA SHARE OF THE VALUE OF THE IMPROVEMENTS! Many property owners have been swindled out of thousands of dollars by allowing lawyers and the State to roll the improvement value of a home, garage, or some other building, into the value of the property. One property owner in Hillsborough County, Florida was cheated out of over $80,000 by such a shyster trick. When I learned of this fraud from the victim of abuse, his four years statute of limitations had expired and no attorney would assist him in getting his money back. When I pointed this error and robbery out to officials of Hillsborough County they just grinned and walked away. If you do not assert your own rights then they will take them away from you and make you believe all along they were doing you a great service.

What is the value of the TIITF Easement?

I ask this question of Lee Pallarady appraiser for the City of Tampa on the 40th Street project. He told me appraisers are told what to appraise and how to appraise and they work within these parameters to find the value the client has asked for. Ok, I said, and just what were the instructions of the City of Tampa on the properties you appraised that had these Murphy TIITF reservations on them? He responded: "I was instructed to appraise them as if there was no TIITF reservation. Therefore I appraised them at the highest and best price." So, I asked, the area encumbered by the TIITF was given the same value as the balance of the property? Yes, he responded. So, there you have it from the mouth of an appraiser. The TIITF reservation has the square foot value of the rest of the parcel. Now, I asked, have you ever appraised a TIITF reservation and gave it no value? He replied yes. When I am instructed by my client not to give it a value then I take the area of the reservation to be condemned, multiply that by the square foot value of the unencumbered portion and deduct it from the total appraisal. So, I asked, whether or not it has a value depends on the wish of your client? Yes, he responded. I ask if he ever appraised the underlying fee title to the TIITF easement? He replied he had never done so when told not to give the easement any value. So, I asked: if the government tells you the underlying fee has no value and do not give it one you don't? Correct he said. Mr. Pallarady is not the only one who follows this procedure. I talked to an attorney at The Fund and he said the underlying fee had no value to the property owner. I asked this attorney: if the underlying fee has no value why do you pay settlements to property owners for loss of the fee when you miss one of these reservations? He gave me some riddle that didn't make sense.

The real truth is the easement has the same value as the rest of the property. That is why it is taxed the same. That is why when these properties are sold this portion does not reflect a zero value to the purchaser and the buyer only pays for the unencumbered portion. The easement has value. The condemning authority deducts that value from any settlement they offer to the property owner. Now the question is, what is the fair division of this equity between the government and the property owner? The government says it owns all the value and has been stealing the property owner's portion of the value since the 1940s. The government takes all the value as if it is the holder of the fee title. What has not been decided is if the use of the easement totally excluding the property owner without compensation is taking without compensation and unconstitutional. In most cases of easements the owner still has some use of the easement for his own purpose he is not totally excluded. I do not think there is a court case that a TIITF easement is considered a "SPLIT FEE". An "easement" is a nonpossessing interest held by one person (or entity) on land of another. When the government takes possession, seizes the easement, and excludes the property owner is this a taking? Is the building of a road upon a portion of ground possession where the fee title owner is fully compensated and not possession where the fee title owner is not compensated?

It is my personal opinion that a fair distribution of the value of the TIITF easement would be 50/50 if the underlying fee is not conveyed and 75/25 when the fee is conveyed with the 75 to the property owner. The condemning authority should give some value to the owner for his fee title. I do not think it is fair or constitutional for the government to take the whole value as it has done these 60+ years. I think it only fair that since they stole the landowner's value telling him/her the land was worthless, then slammed the door on suits by legislation, that the future taking of easements with full compensation to property owners would be a catharsis for the government and restitution for lying and highway robbery.

Are You Entitled To A Free Attorney If The State Uses the TIITF Easement?

A property owner is not always entitled to a free attorney I am told by City of Tampa. According to Jim Burnside of the City of Tampa, if the condemning authority uses only the TIITF reservation it does not have to provide an attorney for the property owner. He said if the property owner gets one penny of compensation for any reason he/she might be entitled to a free attorney at government expense. So, it appears presently you are entitled to an attorney to represent you if you get money and none if you don't. I am not sure this is what the eminent domain provision of the Constitution had in mind. It was my understanding that if any right of the property owner is taken in eminent domain the fee owner is entitle to government paid attorney to represent him. The key here to me is the words "eminent domain" not if the property has value to the fee owner and not if the easement is taken without compensation. I am not an attorney and certainly not a judge, but the way I read the constitution any and all acts of eminent domain grant the property owner a government paid attorney to represent the landowner.

Here is the Florida Constitution on eminent domain and there is nothing here that says a property owner is not entitled to an attorney if an easement only is used:

SECTION 6. Eminent domain.--

(a) No private property shall be taken except for a public purpose and with full compensation therefore paid to each owner or secured by deposit in the registry of the court and available to the owner.

(b) Provision may be made by law for the taking of easements, by like proceedings, for the drainage of the land of one person over or through the land of another.

The use of an easement and the TAKING of an easement is two different things. When the property of an easement is taken by eminent domain then all the rights of eminent domain should kick in. Now if there is a Statute, or a law in Florida that use of an easement precludes a landowner from eminent domain rights to a government paid lawyer, then I want to see it. A search of Florida Statutes for "eminent domain easements" returned a 0 (zero). The same results on search for "eminent domain reservations." The same for "Murphy Deed Reservations." I found nothing in the Statutes that preclude a property owner of an attorney even if the condemning authority plans only to take a portion of a legal easement. The issue here is if the easement is legal and if a court has so rendered this opinion. It is presumptuous for there to be a legal claim a particular easement is legal when it has not been so declared by a court. Now we are not talking about the validity of a deed here, but rather the legality of an easement reserved on the deed. If a reservation is not valid on a conveyance of 10 or less acres, then the easement is not legal. This must be decided and thus it has been decided in Mann v. State Road Department that an easement reserved on a deed conveyed with less then 10 acres is NOT VALID. This is the presumption of law until it is overturned. And thus far it has not been overturned.

I say all property owners who hold fee title to a parcel that was conveyed by the Trustees that contains ten acres or less is entitled to compensation without any loss of value. And this entitles a property owner to a government paid lawyer to represent them. I also believe even in the taking of a legal easement the property owner is still entitled to legal representation paid for by the government.Can Federal Funds Be Used To Purchase TIITF Easements?

Yes!

Many times the condemning authorities say they have no money to pay for TIITF easements and so they must take them for free. This is a big FAT LIE. The fact is, if the condemning authority calculates the fair market value for a parcel when considering the easement, and presents this value along with all other estimated cost of the project to the Federal Highway Administration, the FHWA will give the money to purchase the TIITF easement. The FHWA will give money to buy WHAT EVER INTEREST IN LAND IS NEEDED FOR THE PROJECT. If the condemning authority says they want the fee title underlying an easement and are willing to pay the full market value for the parcel and not discount the value of the easement, they can use Federal funds to pay for it.

The proof is in the pudding. So, in 1997 I wrote to FHWA and ask the question. Here is the response. Go read it for yourself.

Now, if the City of Tampa submitted to FHWA a request for federal funds to purchase right-of-way and this money was included in any project award, then the City of Tampa ought to pay the property owner and take their gun down from his/her head and demanding the easement be deeded free and clear or they will not pay a penny. Taking federal money under pretense for right-of-way and then misappropriating it to another part of the project should be a crime. I guess we will just have to review all the documents and see just what the City of Tampa submitted via FDOT. Were I an attorney representing a client I would seek these documents right from the get go.

Yes, Federal money can be used to purchase Murphy Act TIITF easements. Now the thing is why when Federal money is being sought is this cost not figured in and give the property owner the full benefit of his constitutional right under eminent domain. If the Federal government will pay for it, something NEVER CONSIDERED IN 1941 by the Trustees, then why is it considered wrong of the property owner to seek compensation for eminent domain no matter where he may look for it?

Fairness and honesty should be a big part of community relationship with the condemning authority. To often the government is a bully and the employees in policy making position use all their manipulative powers to hurt and bring financial loss to a property owner who does not let them have their way.

What lawyers should collect and have in their files:

Copy all the web pages here along with all the images. You can save these on a CD and have them available where ever you are with your lap top. I give all my research and all of my efforts to the public for free use. If you want to make a donation to our Church that is ok. But if you do not then that is ok also. My Church has paid for my learning and trips over the past ten years and if by this I am able to help anyone recover an award then we are happy. Would you at least send an email of your opinion of these pages.

1.) Copy of all the motions of the Trustees from 1937 to 1945. This covers all the important dates.

2.) Copy of General Florida law passed in 1941 that designates State Roads in your county.

3.) Copy of Florida Statutes that define "state road" in 1939-1941 Statutes.

4.) Copy of Florida Statutes that describe how a road may be taken for maintainence.

5.) Copy of TIITF Board Rules and Policies regarding release of Murphy Act reservations, start with 1941 and come forward and get copies of all changes and updates of the Rules.

6.) Copy of FDOT Rules and Policies regarding release of Murphy Act reservations, start with 1941 and come forward and get copies of all changes and updates of the Rules.

7.) Copy of FDEP Rules and Policies regarding release of Murphy Act reservations, start with 1941 and come forward and get copies of all changes and updates of the Rules.

8.) Copy of all FDEP, FDOT, or TIITF Board applications to be used by the public for release of Murphy Act reservations, start with 1941 and come forward and get copies of all changes and updates of the Rules.

9.) FDOT was to maintain Log Books of the Murphy Act requests for release. Know where these are, go review them, make sure they are available, and if possible see if this information has been microfilmed.

10.) Purchase a copy of the microfilms of Murphy Deeds issued in your County. FDEP will sell these to you for under $100.00.

11.) Obtain from FDOT copies of all state road maps issued by the State Road Department from 1930 to 1945. This is important to have. Get maps 1930-1945 also from the County you reside in as well as the City or municipality.

12.) Request from FDEP a copy of all tax certificates used to back up the right to sell a parcel or tract as a Murphy Act land. Only those lands 1937 back are those in the Murphy Act. These are on microfilm and they have a responsibility to provide these if they claim the TIITF reservation is valid.

13.) Request from FDEP a copy of the list of all Murphy Act deeds on which the reservations have been totally or partially released in your county. Agree to pay for the copying.

14.) Request from FDEP availability to review the applications of citizens who requested release of reservations on their deeds and anything else that might have been in the applicants file (in your county). These are public documents they should still exist some where in hard copy or on microfilm.

15.) Make copies of all Florida Statutes that pertain to the Murphy Act road reservations and those repealed in 1984 make a note of them. Document the change in wording. Past court cases based upon wording that has been repealed or amended cannot be relied upon as a defense. Change in wording can also foreclose against the state certain rights and powers.

16.) Obtain a copy of a Certificate as described in F.S. 253.82 and keep this on hand to assist Tax Collectors in what to file.

17.) Keep a copy of all relevant Murphy Act road easement cases and decisions and especially Mann v. State Road Department.

18.) Get a copy of all Rules and Policies in regard to Murphy Act reservations and releases in the County in which you live. Collect a copy of every revision or the older Rules replaced by revisions. The purpose is to document that there is different treatment of Murphy Act deed holders. The intent of the Grantor is said to be one thing for 37 years and then it was changed. Was the intent of the Grantor right for 37 years and wrong now because of the changes, or wrong then and right now?

19.) Get an English professional to render an opinion on the language of the Murphy Act reservations as one sentence bisected by a colon and a semicolon and if the leading ten acre clause applies to all reservation within the one sentence. Get these in the form of an affidavit.

20.) Collect all the legal decisions you can on the sanctity of the intent of the Grantor and the acceptance of this intent by the Grantee of the conveyance. Use estoppel as a means to preserve the intent. Until intent is certified estoppel cannot be a remedy of law. Intent should be reached so the right of estoppel cannot be denied on motion. .

21.) Get copies of all plats of record of the area the land is located which is the subject of your client. Make sure the names on this filed plat match the names in the 1941 legislation designating certain roads as state roads.

22.) Join the Florida Bar Eminent Domain Committee, or a local Bar and get involved and start establishing a better understanding of the Murphy Act reservations.

23.) If you desire a speaker on these issues just send me an invitation.